“Our target group is all above 21 years, over 800 million people. Gupta shares an estimate of how 1.3 billion people consume 20 billion bottles of alcohol every year which is a huge market potential. The market is oversaturated with endless brands in every segment, beer, wine, vodka, etc, but the ‘alco-pop’/ RTD segment was the only untapped market which we did not want to miss,” says Gupta.

Seltzers offer premium elements like jasmine and lemongrass, making the blends unique. This generation wants to celebrate, feel the tipsiness and at the same time remain fit. “India is a youth-driven population and loves to experiment. Thus, for a trending segment in the US, but not so in India, the consumption will increase as a better alternative for the youth, feels Ruchi Gupta, founder and CEO of beverages startup Barbrew Beverages that launched Barneys during the lockdown in May 2020.īarneys introduced the brand with the first batch of 24,000 cans sold in Goa in January 2022 and plans to capture four states-UP, Chandigarh, Delhi, and Telangana-as well as one international market (Australia) in a month’s time.

On an average, seltzer is one of the most accessible and cost-effective categories ranging from ₹100 to ₹150 per can. Indian Standard Time expects to grow at a CAGR of ~120% in the next five years beating the market-defined CAGR by 30%, adds Shah. Shah plans to expand IST to Daman, Bengaluru, Delhi, Maharashtra, and Telangana in the coming months. Low-calorie cocktails like hard seltzers offer a refreshing alternative, without compromising on taste and quality,” says Krupa Shah, co-founder of Indian Standard Time aka IST, a seltzer brand which is currently available in Goa. Taste is supreme with intriguing flavour and consumers are ready to embrace mindful drinking post pandemic.

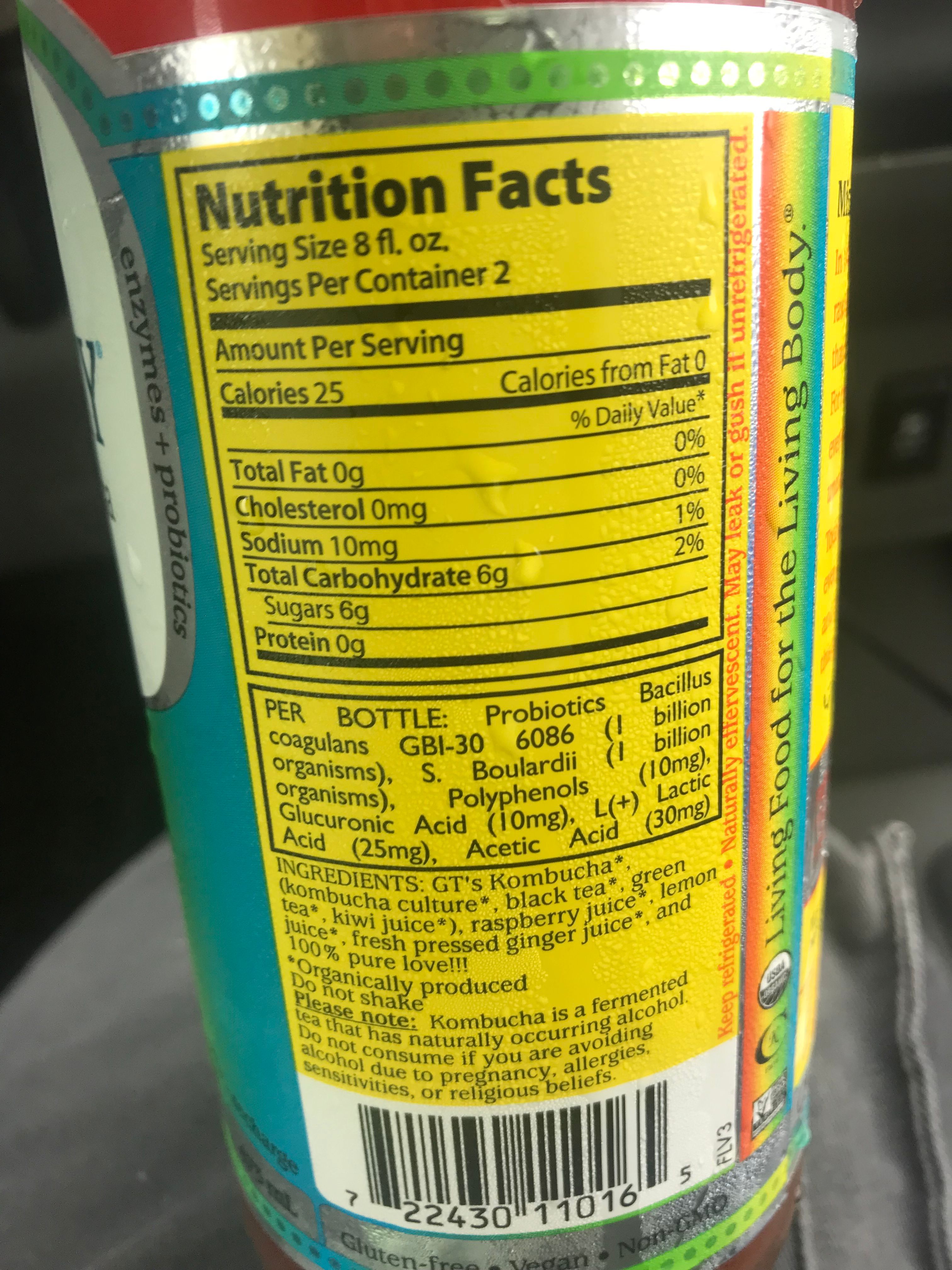

Drinking is no longer restricted to intoxication, bitter experiences, and acquired tastes. “The ever-evolving pool of consumers is becoming more experiential and quality driven. Homegrown Indian brands are already venturing into this unexplored ‘sober curious’ beverage category, largely driven by factors such as regulated drinking habits, health and well-being as the top concerns in the pandemic. This may be a new category in the Indian market but will not take much time once people are aware,” says Mumbai-based mixologist Ninad Raul of Chufang Asian Kitchen and Bar. “The calorie count is greatly reduced with one pint of seltzer containing approximately 80 to 90 calories. IWSR forecasts this category will triple, commanding a market share of 2.6% of all alcoholic beverages by 2023.Īs most people are concerned about the number of calories they consume on a daily basis, especially after Covid, seltzers are said to be a healthier alternative. However, it is now becoming an emerging category in other markets like Australia, Canada, APAC regions including China, Vietnam, Singapore, and India. Led by brands such as White Claw, Truly and Bud Light, hard seltzer has been trending mostly in the US and European markets in the past five years. Globally, a robust demand for flavoured alcoholic beverages and the adoption of low alcohol content beverages are predicted to fuel the RTD alcohol industry and outperform the wider beverage alcohol market, increasing their market share to 8% by 2025, as per the IWSR Drinks Market Analysis.

Synergy kombucha calories driver#

Mighty millets: Underrated powerhouse of nutrientsĪccording to the International Wine and Spirits Research (IWSR), hard seltzer is forecasted to remain the primary driver of RTD volumes in coming years, accounting for half of all global RTD volumes by 2025 (up from 30% share in 2020), driven by consumer demand for flavourful drinks with “better-for-you” attributes.

0 kommentar(er)

0 kommentar(er)